An explanatory chart shows how health insurers have found a way to increase profits by reducing care for the elderly

You are currently reading the web version of Health Care Inc., STAT’s weekly medical cash flow newsletter. Sign up to receive it in your inbox every Monday.

‘#1 PRIORITY’

Emails from within the UnitedHealth Group doctor sounded nice, but they were all business.

One email blared “ADDITIONAL BONUSES!!” for doctors who have arranged more time to meet with them, which encourages them to meet with elderly patients on weekends. One showed how doctors who had spent many health visits with elderly patients got a “WHOA!!” and were eligible for up to $10,000 in bonuses. “#1 PRIORITY”, one email said, was chronically ill patients.

The ultimate goal? Generating more money from these patients, who were on Medicare Advantage. The e-mails provide information about UnitedHealth’s business plan to recruit its doctors to collect cash-generating tests from Medicare Advantage patients. Because the government pays insurers more for sick patients — a process known as risk shifting — UnitedHealth uses its unsettled control over its doctors to force them to see those patients. they are as sick as possible on paper, STAT found.

Read more from the latest installment of the Health Care Colossus series from Tara Bannow, Casey Ross, Lizzy Lawrence, and myself.

Chaos inside CVS

With investors breathing down their necks, CVS Health fired its CEO, Karen Lynch.

The main problems within CVS are not its pharmacies or its MinuteClinics or its pharmacy benefit manager. The biggest problem was Aetna, the health insurance company that CVS bought for $69 billion in 2018. And Aetna’s biggest hit last year was its Medicare Advantage business, where the company which has signed up more members than any other insurer by 2024 but. it did not know how much attention the new writers would use.

Lynch was Aetna’s top lieutenant after former CEO Mark Bertolini walked off into the sunset (and then resurfaced at Oscar Health). His tenure at CVS appeared limited after his Aetna colleague Brian Kane was forced out in August.

His representative, David Joyner, may indicate where CVS is headed. Joyner led the company’s PBM, the company’s true revenue generator and probably greeted the idea that PBM would be central to all of its efforts going forward.

“Usage” continues

Low-income patients who rely on Medicaid have access to more procedures and prescription drugs, and that’s bad news for Elevance Health. The Blues insurer posted third-quarter earnings last week that sent its stock into a tailspin, and brought its peers along for the ride, Tara reports.

If you have déjà vu, Tara writes, it may be because we have also reported on insurers struggling with high costs in a different government program: Medicare Advantage. (Ahem, see above.)

The situation is somewhat different with Medicaid: People who kept Medicaid coverage after states determined their eligibility are often sicker and need more care. The gap between the high demands of members and the money that states pay insurers to cover appears to be widening, at least in the case of Elevance. That surprised several Wall Street analysts on Elevance’s earnings line, who wondered why the opposite hadn’t happened, especially since other countries have agreed to make changes between the years. to their payment rates.

Elevance had no satisfactory answers, but CEO Gail Boudreaux told analysts that she believes the issues surrounding Medicaid are “time bound.” Even the KFF Medicaid specialist Tara spoke to was not sure why that was happening. Read more.

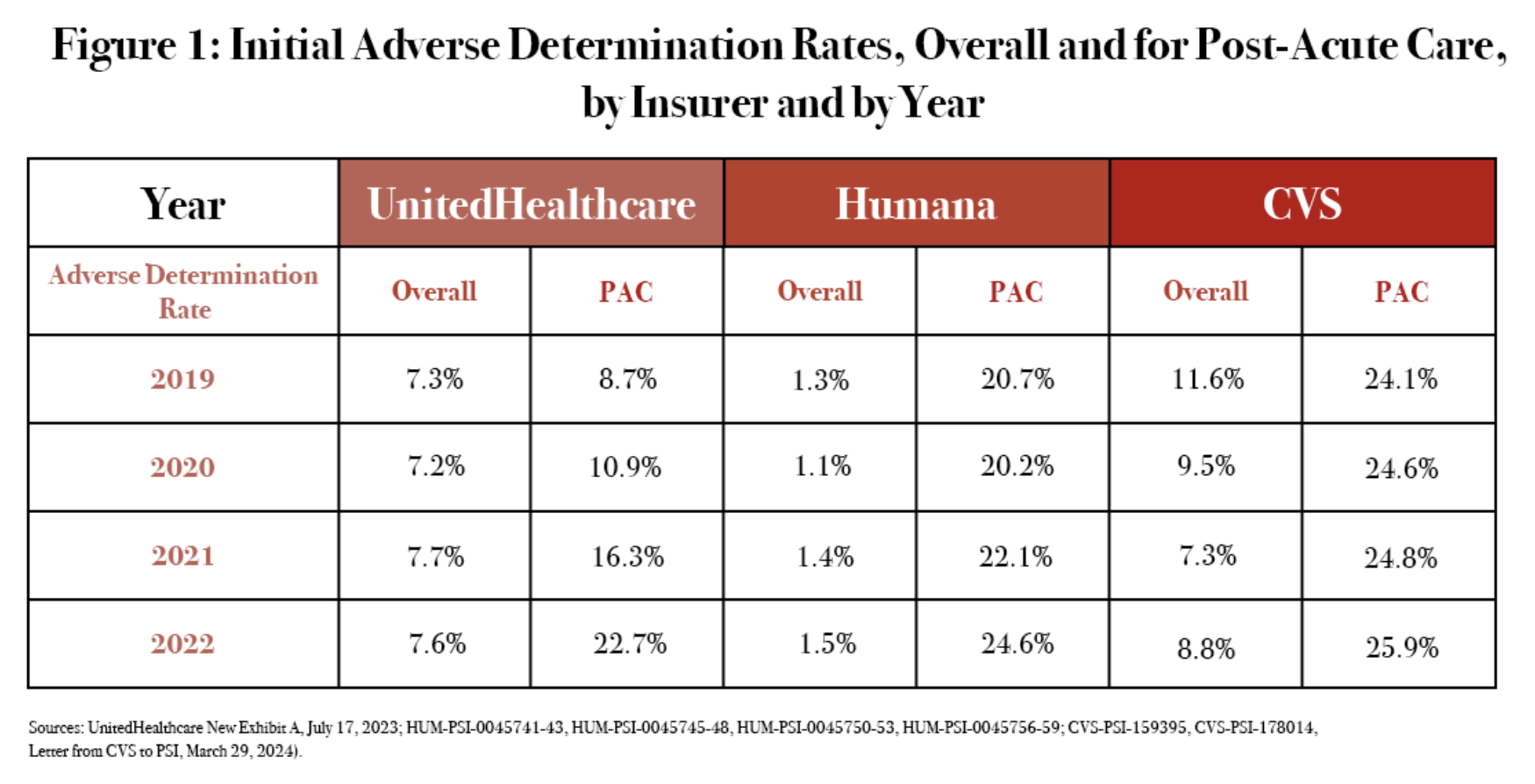

Refusal fees, listed

As of 2022, the three largest Medicare Advantage insurers — UnitedHealthcare, Humana, and CVS Health’s Aetna — were denying nearly a quarter of all claims for secondary care. The sharp increase in denial of care in sick, elderly patients coincides with the increasing use of algorithmic tools. That’s all according to a new Senate subcommittee report that heavily cites the AI-Rejected STAT series from last year.

Sections of the Conference

Did you miss last week’s STAT Conference in Boston? Tara and I were both there, and both of our sessions covered Medicare Advantage.

I sat down with Don Berwick, the former director of CMS during the Obama administration. Berwick took a pessimistic view of Medicare, saying the program is in deep trouble because of Medicare Advantage. He said he doesn’t think the solution is to ban private insurers from the program, but “we have to regulate the hell out of them.” That’s in contrast to another Summit speaker, former Trump adviser Joe Grogan, who blasted the idea of putting everyone on Medicare Advantage plans, in an interview with my colleague Rachel Cohrs Zhang.

Tara was on stage with three doctors that STAT interviewed as part of our Health Care Colossus investigation into UnitedHealth. Doctors said UnitedHealth promised a vision of quality-based care that ultimately did not materialize. One of them said it sounded like a “bait and switch.”

Industrial problems

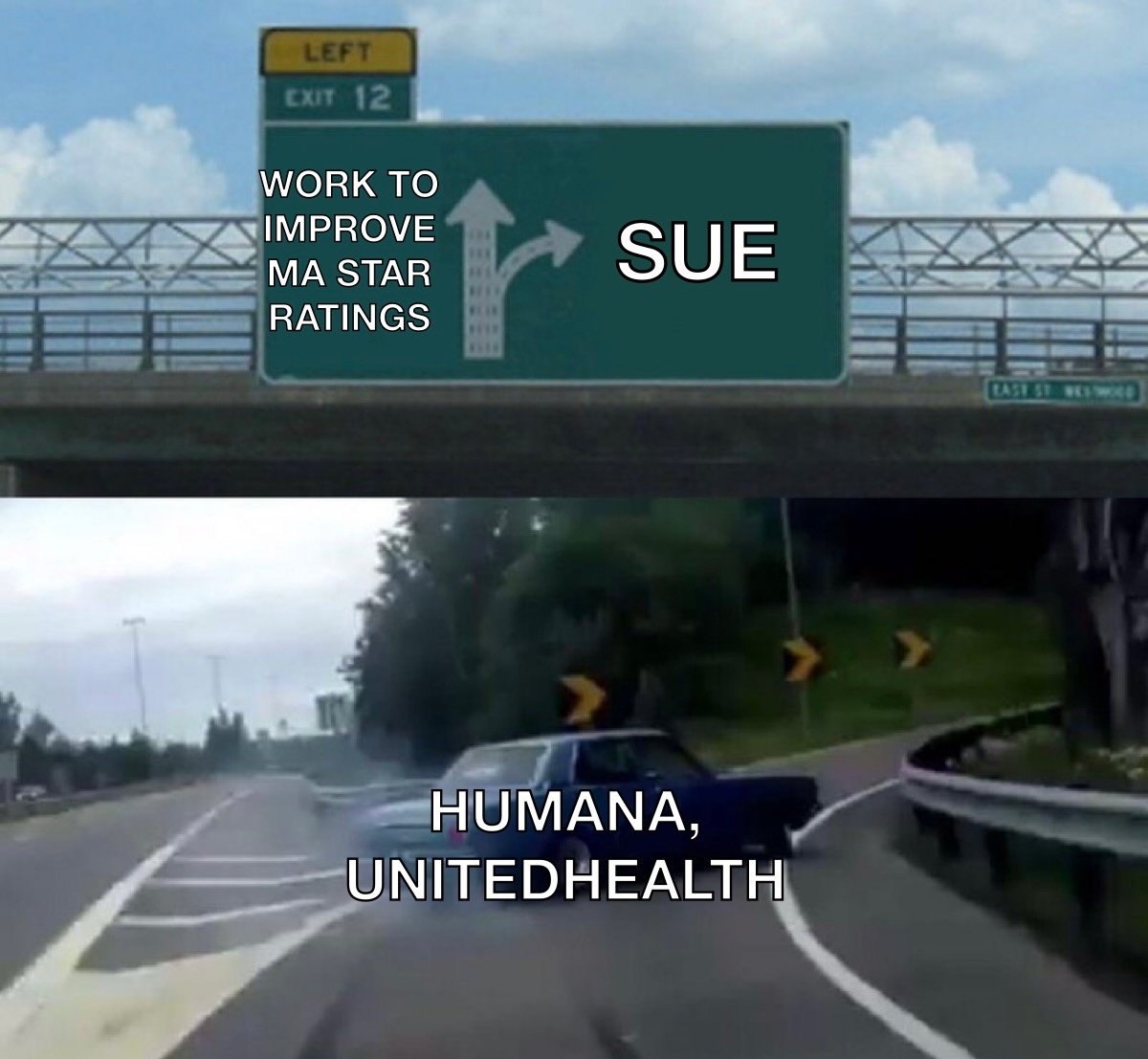

- Humana finally did it: Friday evening, the company sued HHS and CMS (full lawsuit here) over its Medicare Advantage star ratings that were downgraded, following UnitedHealth’s actions.

- The VA is investigating Acadia Healthcare for fraud concerns, Jessica Silver-Greenberg and Katie Thomas report in the New York Times.

- Hospitals and clinics will buy $63 billion of prescription drugs through the federal 340B program in 2023, a 23% increase from 2022, my colleague Ed Silverman reports.

- A report from reporters at The Guardian details how Parkview Health, a nonprofit hospital system in Indiana, has become an expensive, powerful player that has squeezed patients and employers in the area.

- Another hospital system, the University of Vermont Medical Center, is dropping Moody’s as its credit rating agency.

Meme Constituency

#explanatory #chart #shows #health #insurers #increase #profits #reducing #care #elderly